2020年考研英語(一)真題及答案解析:

Text 4

States will be able to force more people to pay sales tax when they make online purchases

under a Supreme Court decision Thursday that will leave shoppers with lighter wallets but is a big

financial win for states.

The Supreme Courts opinion Thursday overruled a pair of decades-old decisions that states

said cost them billions of dollars in lost revenue annually. The decisions made it more difficult for

states to collect sales tax on certain online purchases.

The cases the court overturned said that if a business was shipping a customers purchase to a state where the business didn’t have a physical presence such as a warehouse or office. the

business did 't have to collect sales tax for the state. Customers were generally responsible for

paying the sales tax to the state themselves if they weren’t charged it, but most didn’t realize they owed it and few paid.

Justice Anthony Kennedy wrote that the previous decisions were flawed. Each year the

physical presence rule becomes further removed from economic reality and results in significant

revenue losses to the States." he wrote in an opinion joined by four other justices, Kennedy wrote that the rule limited states ability to seek long-term prosperity and has prevented market

participants from competing on an even playing field.”

The ruling is a victory for big chains with a presence in many states, since they usually

collect sales tax on online purchases already Now, rivals will be charging sales tax where they

hadn't before, Big chains have been collecting sales tax nationwide because they typically have

physical stores in whatever state a purchase is being shipped to. Amazon. com. with its network of warehouses also collects sales tax in every state that charges it, though third-party sellers who use the site don 't have to.

Until now, many sellers that have a physical presence in only a single state or a few states

have been able to avoid charging sales taxes when they ship to addresses outside those states

Sellers that use eBay and Etsy. which provide platforms for smaller sellers, also hat

collecting sales tax nationwide. Under the ruling Thursday, states can pass laws

out.. state sellers to collect the state's sales tax from customers and send it to the stale

Retail trade groups praised the ruling. saying it levels the playing field for local and online

businesses. The losers, said retail analyst Neil Saunders, are online-only retailers especially

smaller ones. Those retailers may face headaches complying with various state sales tax laws. The

Small Business Entrepreneurship Council advocacy group said in a statement "Small

businesses and internet entrepreneurs are not well served at all by this decision.

36. The Supreme Court decision Thursday will

A. Dette business relations with states

B. put most online business in a dilemma

C. make more online shoppers pay sules tax

D. force some sates to ct sales tax

37. It can be learned from paragraph 2 and 3 that the overruled decisions

A. have led to the domainance of e-commerce

B. have cost consumers a lot over the years

C. were widely criticized by online purchase

D. were consider unfavorable by states

38. According to Justice Anthony Kennedy, the physical presence rule has

A. hindered economic development

B. brought prosperity to the country

C. harmed fair market competition

D. Boosted growth in states, revenue

39. Who are most likely to welcome the Supreme Court ruling

A. Internet entrepreneurs

B. Big- chair owners

B. Third-party sellers

D. Small retailers

40. In dealing with the Supreme Court decision Thursday the author

A. gives a factual account of it and discusses its consequences

B. describes the long and complicated process of its making

C. presents its main points with conflicting views on them

D. cities some saces related to it and analyzes their implications

責(zé)任編輯:楊林宇

特別聲明:本網(wǎng)登載內(nèi)容出于更直觀傳遞信息之目的。該內(nèi)容版權(quán)歸原作者所有,并不代表本網(wǎng)贊同其觀點(diǎn)和對(duì)其真實(shí)性負(fù)責(zé)。如該內(nèi)容涉及任何第三方合法權(quán)利,請(qǐng)及時(shí)與ts@hxnews.com聯(lián)系或者請(qǐng)點(diǎn)擊右側(cè)投訴按鈕,我們會(huì)及時(shí)反饋并處理完畢。

- 2020考研英語聽力原文/翻譯/作文范文整理匯總 2020年考研英語一二真題答案完整版2019-12-27

- 考研英語大小作文翻譯范文答案 2020年考研英語一閱讀完形填空答案完整版2019-12-26

- 考研英語聽力原文作文范文整理 2020年考研英語一二真題答案完整版2019-12-26

- 最新見多識(shí)廣 頻道推薦

-

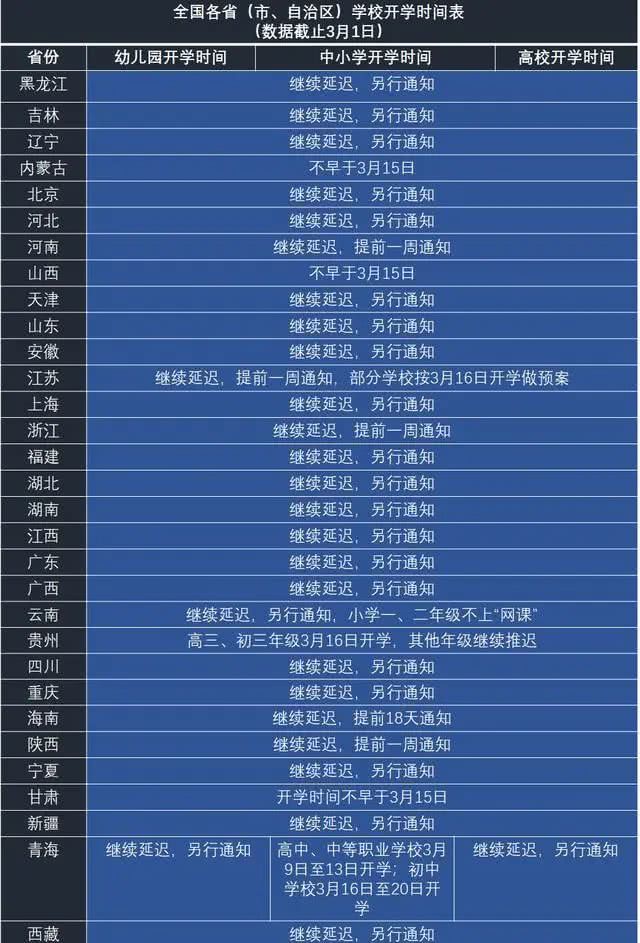

2020各地開學(xué)開學(xué)時(shí)間表最新匯總 哪些地方延2020-03-12

- 進(jìn)入圖片頻道最新圖文

- 進(jìn)入視頻頻道最新視頻

- 一周熱點(diǎn)新聞

已有0人發(fā)表了評(píng)論